Many thought that private properties would fall outside of this category. If sold within 3 years.

Gst Impact On Construction Capital Costs Download Table

GST is charged on all taxable supplies of goods and services in Malaysia except those specifically exempted.

. In Malaysia the sale of commercial properties including land zoned for commercial purposes is usually subject to 6 GST. GST is a tax on the supply of most goods and services in New Zealand. If sold before 5 years.

The businesses that perform their activities in Malaysia and internationally will have to pay SST if they exceed a particular annual. Rent and Returns. If you owned the property for 12 years youll need to pay an RPGT of 5.

If sold before 4 years. For The First RM50000000 10 Subject to a minimum fee of RM50000 For The Next RM50000000 080. GST is also charged on importation of goods and services into Malaysia.

March 18 2015 Henry Chin Sheh Ho. First RM100000 RM100000 x 025 RM250. In the GST era tenants needed to pay 6 of the rental value of a commercial property to the property owner if the propertys annual rental exceeds RM500000.

In many cases GST is not charged on the sale of a residential property but it can apply depending if the seller is GST registered and. Malaysia such brokering services on the property sale transaction may also be provided by the brokers. As one of the most sophisticated sectors undoubtedly property and construction industry faced greater challenges in complying with GST rules.

Sale And Purchase Agreement Legal Fees 2022 SPA Stamp Duty And Legal Fees For Malaysian Property. Any transfer of real estate in Malaysia attracts ad valorem stamp duty that is calculated on the purchase consideration or its market value whichever is higher. However according to the guidance released by the authorities the facts.

In this content we use the more common term property instead of the technical term real property. Still to pay for 1 year. Find out everything you need to know about Property Taxes in Malaysia.

Purchaser has the right to purchase the commercial properties from a non registered vendor. Sale of commercial properties will be subject to 6 GSTDevelopers may choose to absorb GST as part of their sales package. However for the purposes of GST regardless whether brokers are liable to be registered under.

New guidelines were issued recently by the Royal Malaysian Customs Department that includes more people being required to pay the Goods Services Tax GST when selling a commercial property The Star reported. Payment of tax is made in stages by the intermediaries in the production and. For The First RM500000 10 Subject to a minimum fee of RM50000 For The Next RM500000 080.

The sale includes both a residence and other property such as a farm or a shop. Tax payable Net Chargeble Gain X RPGT Rate based on holding period RM171000 X 5. Learn about these 5 different property taxes that you absolutely need to know about.

In the GST era tenants needed to pay 6 of the rental value of a commercial property to the property owner if the propertys annual rental exceeds RM500000. But many people are still unsure as to its full impact on the countrys property market especially the housing sector. Total valuation fees RM250 RM800 RM1050.

For The Next RM2000000 070. Youll pay the RPTG over the net chargeable gain. A zero rate of GST may apply for instance in cases where the recipient contracting party of the services is a non-resident and is outside Malaysia at the time.

Effective 1 April 2015 any supply of rights to use IP made in Malaysia by a GST registered person will be subject to GST of 6. For resident company with paid up capital of RM25 million and below at the beginning of the basis period the tax rate for first RM500000 chargeable income is 19 reduced to 18 in YA 2017. Malaysia Sales Service Tax - SST was re-introduced on 1 Sep 2018.

The schedule below as a reference of stamp duty and legal fees when purchasing a house. Total rental of the furnished flat 4500 per month. TaxSST was officially re-introduced on 1 September 2018 replacing the former three-year-old Goods and Services Tax GST system.

Unlike the estate agents and negotiators the brokers are not registered under the Valuers Appraisers Estate Agents Act 1981. Sale of residential property is GST exempt. For The Next RM2000000 060.

Latest Update 2022 Professional Legal Fees. Below is the table. Value of supply of furniture and fittings per month 4500 - 3000 1500 per month.

For non-resident individuals the income tax rate is 28. By 9 July 2015 we usher 100 days on from the start of GST one of the major pieces of tax reform the country has seen. In other words non-commercial properties are not subject to the 6 GST.

Can a purchaser choose not to pay GST to the vendor. Malaysias government recently rolled out the new Goods Services Tax GST on 1 April 2015. However developers will pay GST on some of their production inputs.

So for example if your house value is at RM500000 the valuation fees calculation would come up to this. Keep in mind that tax rates change frequently and you should check the latest government information for up-to-date data. It may be viable to invest in investment property.

RPGT increases progressively as follows for commercial property. Purchaser can easily check whether the vendor is registered under the GST from wwwgstcustomsgovmy. If sold after 6 years.

Goods and Services Tax GST is a multi-stage tax on domestic consumption. You must charge GST on 1500. Of course there are no rules that say that you need to get your property formally.

Meanwhile the tax rate for company is 24. In cases where the transfer is done pursuant to Sale and Purchase Agreement entered into with a developer two situations can arise-. GST can apply to people who buy and sell property.

Property sector still grappling with GST issues. Only property agents on their own or work for a company who surpass an annual turnover of RM500000 per year are required to charge SST on their services provided to property buyers. Value of exempt supply per month 112 x 36000 3000 per month.

Assuming your property price on the SPA is RM700000 lets work out how much you would have to pay for the Property Stamp Duty. Goods and services tax GST applies to the supply of certain property types if the supplier seller or vendor is registered or required to be registered for GST purposes. Sales of commercial real estate such as office towers retail buildings and land zoned for commercial use are subject to a 6 percent.

Annual value in the Valuation List 36000. A singular and non cumulative commercial property of land that is worth more than RM 2 million. 1 on first.

Issues with GST classification. Residue RM400000 x 02 RM800. The fees however follow a standard table whereby the price of the property determines how much a property purchaser has to pay.

When the individual title is available at the time of entering into the Sale and Purchase Agreement the stamp duty assessed will be based on the.

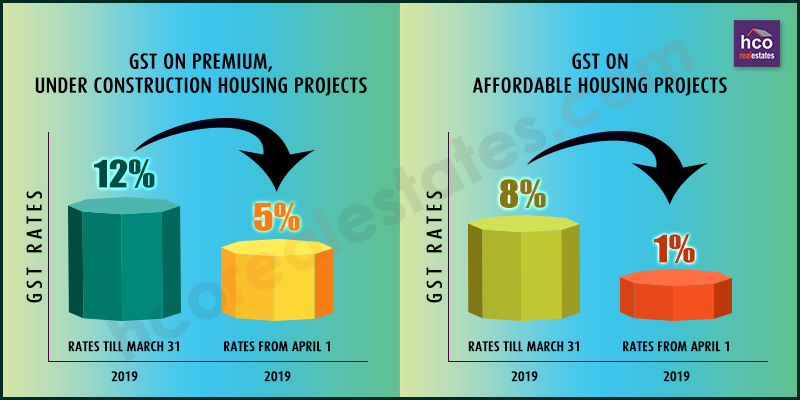

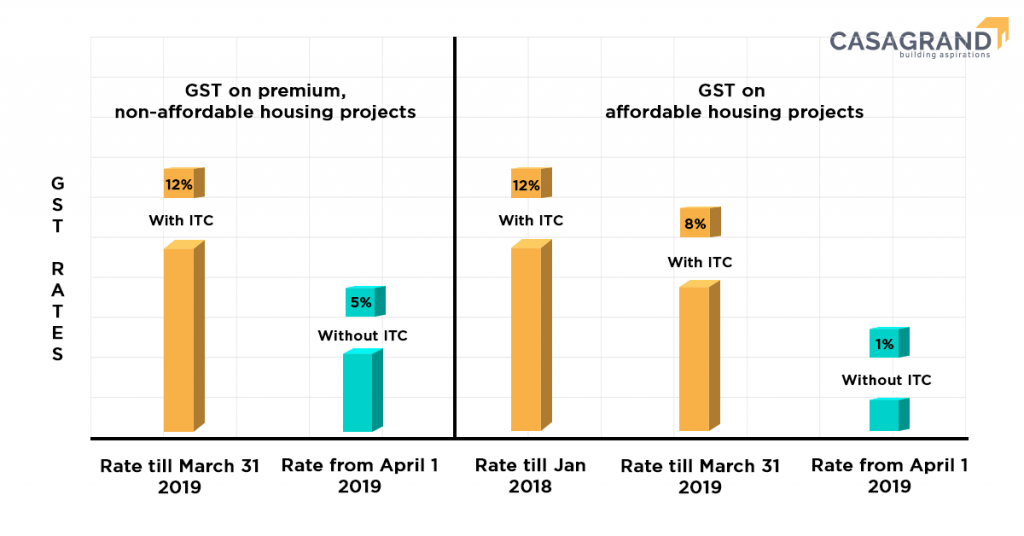

New Gst Rates And Their Impact On Indian Realty

New Gst Rates And Their Impact On Indian Realty

How To Issue Tax Invoice Agoda Partner Hub

Training Modular Financial Modeling Ii Sales Taxes Financial Statements Cash Flow Statement Modano

Legal Articles Helplinelaw Com

Gst Impact On Construction Capital Costs Download Table

Itc On Gst Paid For Construction Of Immovable Property Enterslice

4 5 Bhk Apartments Shree Balaji Wind Park Residential Apartments Ahmedabad Penthouse For Sale

Gst Impact On Construction Capital Costs Download Table

Investing Investment Property Goods And Service Tax

How To Issue Tax Invoice Agoda Partner Hub

Gst Hst And New Residential Rental Properties Welch Llp

Check Out Our Ad In The Times Of India Www Paradisegroup Co In Utm Content Buffer Real Estate Marketing Postcards Real Estate Ads Real Estate Marketing Design

Houz Depot Big Clearance Extended In Malaysia Furniture Promo Depot Extended

Check Out Our Ad In Loksatta Presenting Monsoon Magic Offer Limited Period Advantage Pay 0 Gst Book Today Save Upto Rs 3 5 L Ambernath Eco Luxury Monsoon

All You Need To Know About The Gst On Home Purchases

Duties And Taxes Not Subsumed Into Gst Accounting Taxation Tax Goods And Service Tax State Tax

Impact Of Gst On Real Estate Rgnul Student Research Review Rsrr